How to Mitigate your Resale Certificate Audit Risk

By Tom WeissJuly 27, 2022Every business owner knows that becoming or staying sales tax compliant is simply considered the cost of doing business. Keeping up with various compliance requirements can be challenging to both small and large businesses alike with several culprits and challenges along the way.

“The risk of back taxes, penalties, and interest you may accrue due to mistakes will very likely outweigh cost savings by not utilizing professional exemption certificate management support.”

Wholesalers in particular shy away from accepting resale certificates due to added complexities. Knowing which validation processes are pertaining to accurate and up-to-date tax forms is a daunting task if you are dealing with resale certificates across several states.

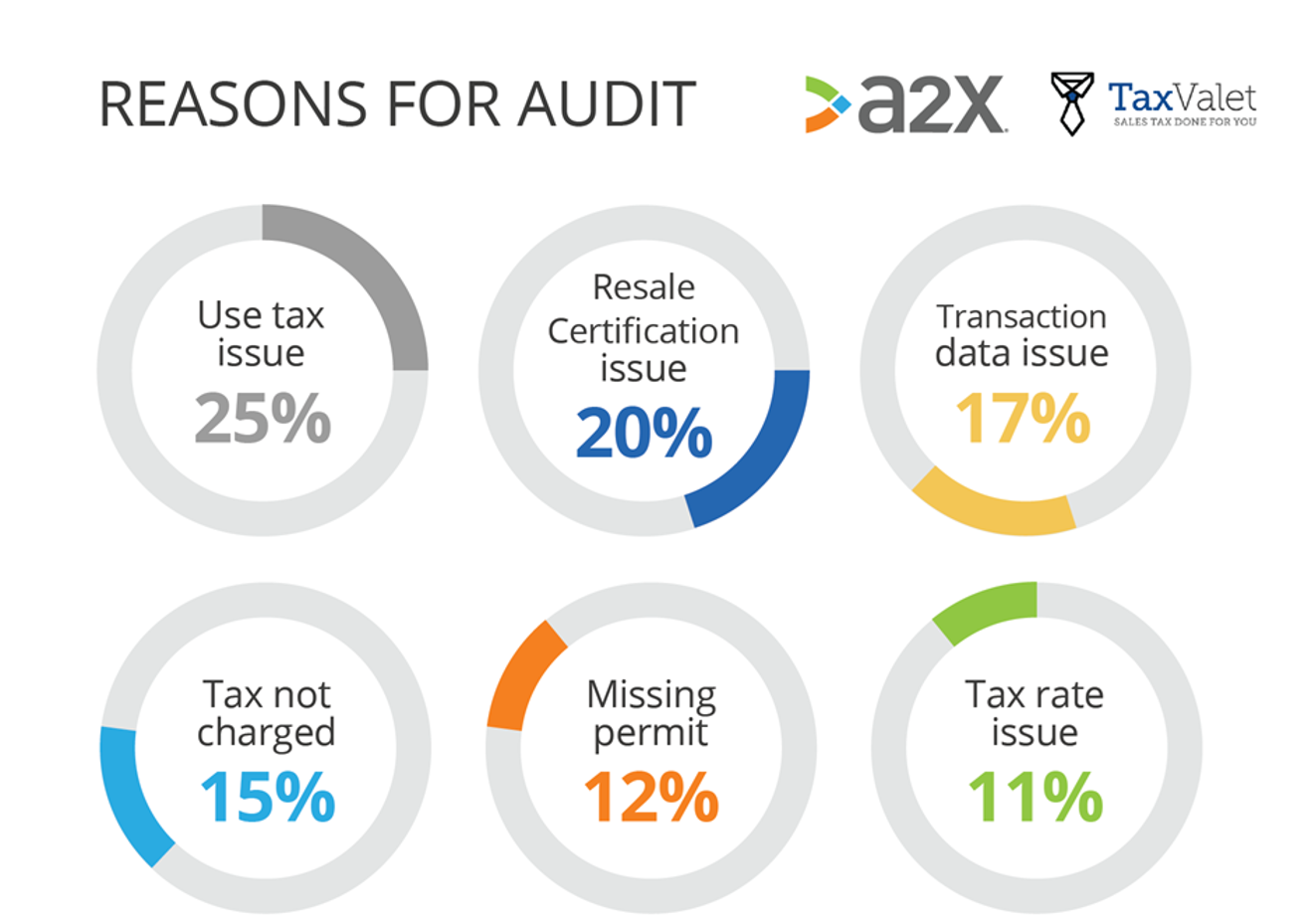

Resale certification issues are among the top audit reasons according to research conducted by TaxValet and a2x Accounting

While it is true that accepting resale certificates does come with added responsibilities and certain liabilities for the seller, the advantages of supporting and accepting resale certificates significantly outweigh the risks. Ignoring resale certificates is often simply not an option – The following steps will help you manage your resale certificates and can reduce your audit risks:

1. Resale certificates are governed at the state level

Each state dictates their own variation of rules and regulations when it comes to deeming a certificate valid or invalid. Make sure that you are aware of all rules and regulations on state level for each form you are accepting – don’t use Google as your trusted adviser to process and validate your resale certificates, but instead use a software platform to help you determine whether forms are good or bad for specific periods of time and purposes.

2. Resale certificates can only be used for a valid purpose

Only accept resale certificates from your buyer which are fit for purpose of the goods or services you are selling to them. In other words, don’t accept a resale certificate issued for airplane parts when you are selling donut dough. Use common sense and think how an auditor would react if he or she has to determine the right purpose. If in doubt, reject the resale certificate and ask the buyer to provide a new one that fits the purpose and satisfies your needs.

3. Always verify your resale certificate

In many states, if you as the seller accept and initiate a tax-free sale to a buyer who presented you with an expired or otherwise invalid resale certificate, then you are on the hook to pay the sales tax if things go wrong. This is the liability you need to be aware of when accepting resale certificates. Always ensure that your buyer’s resale certificate is not fraudulent, expired or otherwise faulty. Make sure you understand how to validate and verify your resale certificates. When in doubt, get back to your buyer and ask for more details and a corrected resale certificate. Again, it is strongly recommended not to guess your way through this process. The risk of back taxes, penalties, and interest you may accrue due to mistakes might outweigh some cost savings by not utilizing professional exemption management support.

4. Nine states (plus Washington, D.C.) don’t accept out-of-state resale certificates

Most states across the US allow out-of-state resale certificates to make purchases tax free for resale. However, these nine states (plus D.C.) do not:

- Alabama

- California

- Florida

- Hawaii

- Illinois

- Louisiana

- Maryland

- Massachusetts

- Washington

- Washington D.C.

Be aware of this rule and reject resale certificates if they are not correctly applied. To take advantage of the resale exemptions in these states, you will need to register to collect sales tax in these states.

5. You can choose to accept a resale certificate

Know that you are in full control and have the right to accept or reject resale certificates which are presented to you. Do not get bullied into accepting forms as some buyers may press you to do so. Even big retailers, such as Target, are notorious for refusing to accept resale certificates at their discretion. Remember, you are likely on the hook for back taxes, penalties, and fines if you do accept invalid resale certificates. Stay on the safe side, apply common sense, and seek help to ensure that your resale certificates will pass an audit.

The best way to manage your tax obligation is to ensure you collect and validate your tax exemption certificates accurately, stay on top of expiring certificates and ensure that you know when certificates are due for renewal. Consider partnering up with a tax service provider who fits your business needs in terms of usability, cost, and commitment.

About EXEMPTAX

EXEMPTAX was founded in 2019. Shortly thereafter EXEMPTAX quickly grew its client base from small businesses to large enterprises. In 2021, EXEMPTAX began partnering with prominent CPA and tax advisory firms across the US on a white label basis. As of 2022, EXEMPTAX handles more than 1 million customer records on its platform and has helped many businesses across the US save money, lower tax exposure, and ultimately reduce their audit risk.