The “Four Corners” Standard

By John SerdarNovember 17, 2020

The “Four Corners” standard also known as the “Fully Completed Certificate” refers to a set of standards utilized by member states of the Streamlined Sales and Use Tax Agreement to relieve sellers of liability if they accept a fully completed tax exemption certificate. This article will seek to expand upon the standard at a high level, and is not intended to cover various grey areas that may occur in implementation of the standard.

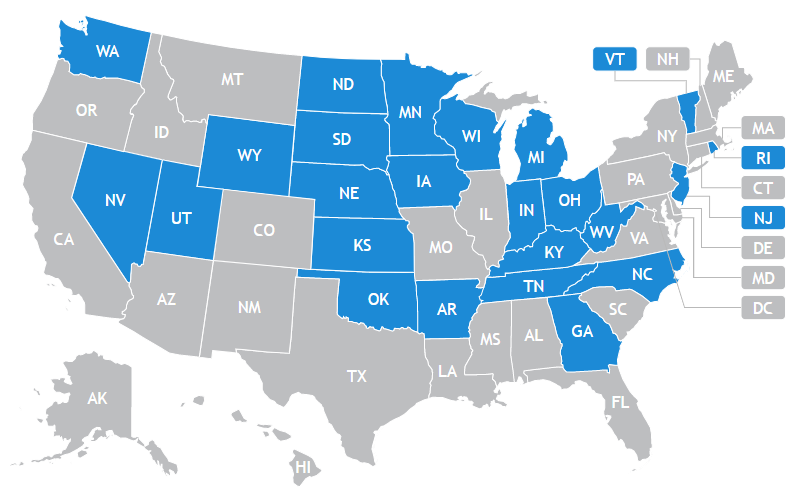

Under the SSUTA, this standard replaces the long-standing “Good Faith” standard and is utilized by the 24 member states, which include:

Arkansas, Georgia, Indiana, Iowa, Kansas, Kentucky, Michigan, Minnesota, Nebraska, Nevada, New Jersey, North Carolina, North Dakota, Ohio, Oklahoma, Rhode Island, South Dakota, Tennessee, Utah, Vermont, Washington, West Virginia, Wisconsin, and Wyoming.

According to the Streamlined Sales Tax Governing Board, a seller will have obtained a fully completed exemption certificate if the seller “captures the information on the form that is part of SSUTA’s required standard data elements.” Those data elements include:

- The purchaser’s name and address

- The type of business

- The purchaser’s reason for claiming the exemption

- The ID number required by the state where the sale is sourced

- The purchaser’s signature

One important item to note is that an otherwise complete exemption certificate can be considered invalid if a retail location in the member state accepts a certificate that the state has affirmatively indicated an entity-based exemption is not available in the state (this does not apply to remote sales occurring outside the member state).

Another significant factor to note is that the fully complete certificate standard is applied to exemption certificates received on the date of the sale, or received within 90 days after the date of the sale. Absent of fraud on the seller’s part, if the purchaser provides a fully completed exemption certificate to the seller within 90 days of the sale, the state auditor must accept the certificate. We do however want to note there are some potential grey areas in the standard’s implementation, as state laws vary as to what constitutes fraud (we recommend you speak to an attorney for details).

While the standard is generally relatively straightforward and not overtly burdensome for sellers, one critical thing to note is that in SSTUA states, within 120 days after receiving a request for substantiation of exempt sales from a member state, a seller with missing or incomplete exemption certificates must provide:

- fully completed exemption certificate taken in good faith (much tougher standard) from the purchaser, or

- other information acceptable to the state establishing that the transaction was not subject to the tax.

If you fall into this latter category with missing and invalid certificates, at EXEMPTAX we’re here to help! Our end-to-end exemption certificate management platform enables business to manage their resale and sales tax exemption certificates from collection to audit in minutes, and reduce their audit risk. To learn more Schedule a Demo Today!